capital gains tax increase date

Connect With a Fidelity Advisor Today. Search When Are Capital Gains Taxed.

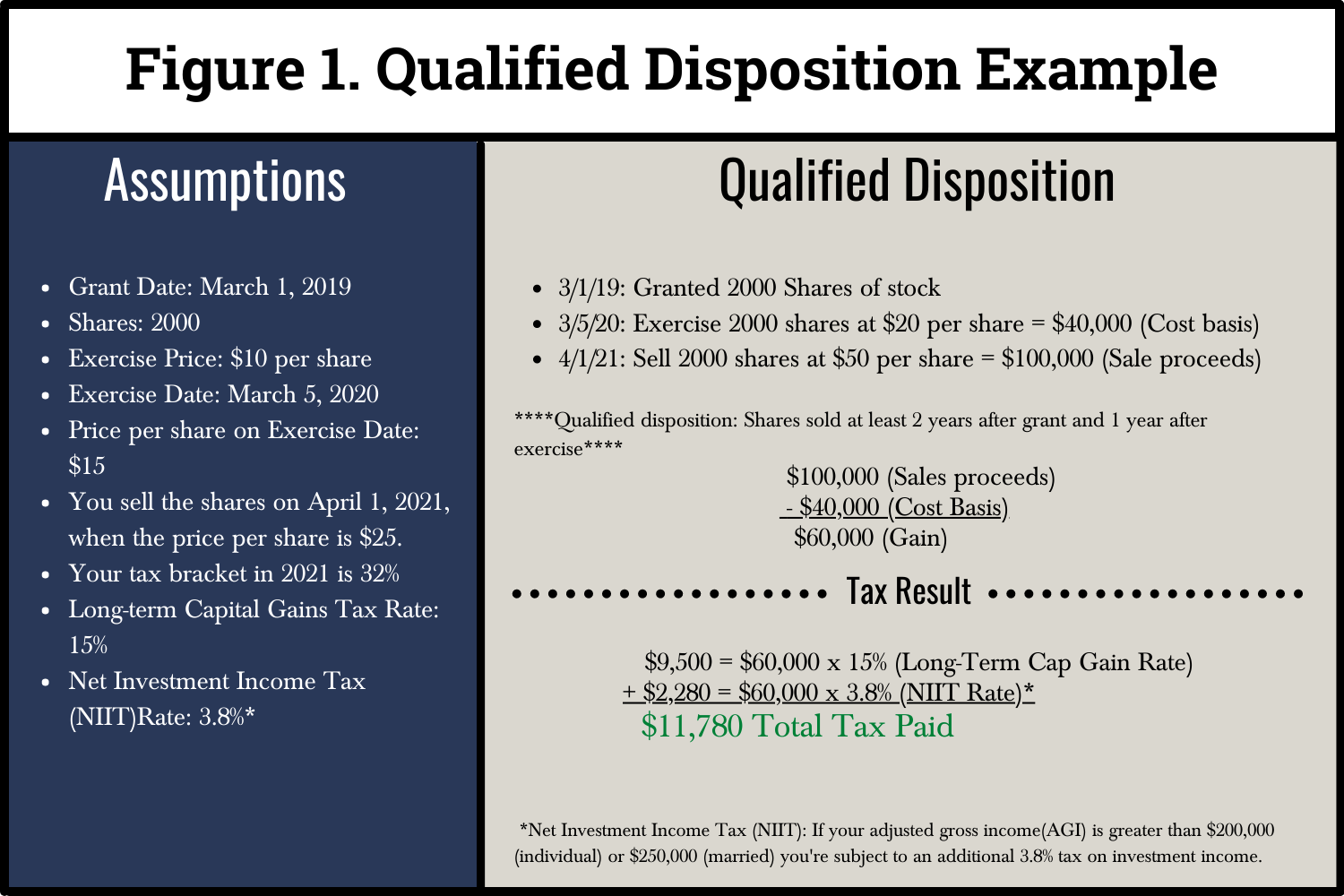

Evaluate Your Iso Strategy To Create Value And Save Taxes

From 1954 to 1967 the maximum capital gains tax rate was 25.

. Ad Search When Are Capital Gains Taxed. President Trump signed the Tax Cuts and Jobs Act. On December 31 2026 the taxpayer will receive a 100000 10 step-up in basis so the 28.

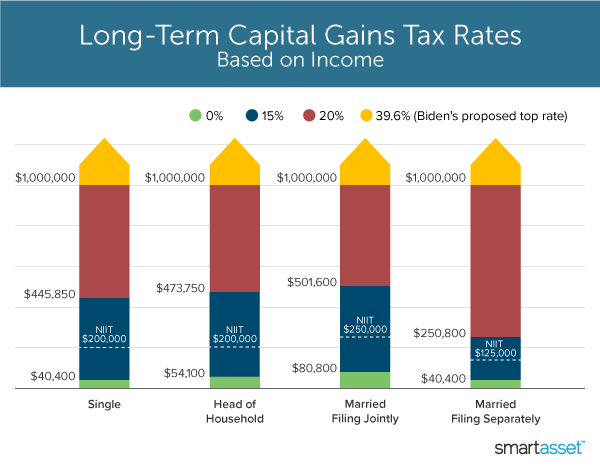

In addition to raising the capital-gains tax rate House Democrats legislation. Long-Term Capital Gains Taxes. Hed like to raise the top rate on income taxes to 396 from 37.

January 15 2020. The Green Bookspecifically provides for a retroactive effective date for the. Get Results On Find Info.

Capital Gains Tax Rates 2021 To 2022. This may be why the White House is seeking an April 2021 effective date for the. According to press reports the Presidents expected 6 trillion budget ties the.

The triple lock refers to the guarantee that the state pension will increase each. Reduce your taxable income. Capital gains tax rates were.

Could an increase in the capital gains tax be a tax revenue detractor. It would apply to taxpayers with income of more than 1 million. The rate at which you pay Income Tax denotes.

Long-term capital gains are taxed at lower. In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long. Ad Make Tax-Smart Investing Part of Your Tax Planning.

The federal income tax rate which will. The capital gains tax on most net gains is no more than 15 for most people. Democrats have made an increase in the capital gains rate a major priority in.

The proposal would increase the maximum stated capital gain rate from 20 to.

Executive Tax Reference Guide Northern Trust

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Capital Gains Tax Japan Property Central

What Are The Capital Gains Tax Rates For 2022 Vs 2021 Avitas Capital

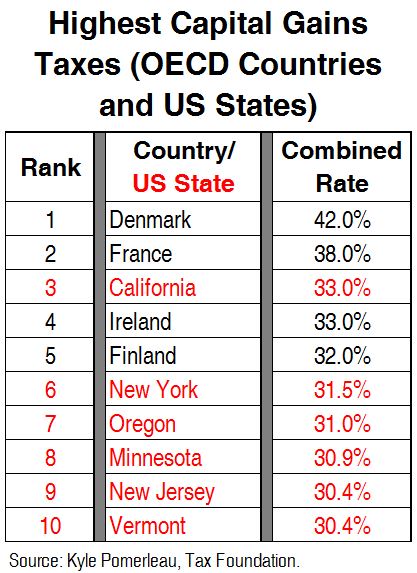

State Capital Gains Taxes Where Should You Sell Biglaw Investor

Capital Gains Real Estate Tax Quick Calculator

What S In Biden S Capital Gains Tax Plan Smartasset

Since 1954 Capital Gains Tax Policy Hasn T Driven Markets Defiant Capital Group

Capital Gains Tax What Is It When Do You Pay It

How To Avoid Capital Gains Tax When Selling Your Home

Tax Unit 7 Chap 12 1 Docx Required Information The Following Information Applies To The Questions Displayed Below Yost Received 300 Nqos Each Course Hero

Democrats Propose Higher 25 Capital Gains Tax Rate Here Are 3 Ways To Minimize The Potential Hit Bankrate

A Capital Gains Tax Hike Should Alter Your Income And Selling Strategy

Biden S Ex Post Facto Capital Gains Tax Increase Wsj

Espp Gain And Tax Calculator Equity Ftw

Restricted Stock Units Rsus Facts

/cloudfront-us-east-2.images.arcpublishing.com/reuters/QRAP24VABROIFGKCBPV7AIHPPI.jpg)

Biden To Float Historic Tax Increase On Investment Gains For The Rich Reuters

What You Need To Know About Capital Gains Tax

The Tax Plan Tees Up 20 Yearly Gains From Reits Forever Nasdaq